When you plan for retirement from federal service, you have several big decisions to make. In addition to planning your income from your FERS pension and TSP distributions, you also need to make sure your healthcare is covered. As a federal retiree, you have two excellent health insurance plans that will work together to cover your needs: FEHB and Medicare.

Both work together, but depending on your age and employment status, one will be your primary and the other your secondary coverage. Here’s what you need to know.

When You’re Under 65: FEHB Coverage During Retirement

Federal Employee Health Benefits (FEHB) is the catchall term for your health insurance as a federal employee. During your employment, you are able to choose from many different healthcare plans within the FEHB program, whether an HMO, PPO, or high-deductible plan with an HSA. As long as you are working and are under the age of 65, your FEHB plan will be your primary—and only—health insurance option.

If you retire before the age of 65, you are allowed to keep your FEHB health insurance as long as you:

- Are eligible for a pension and can collect it right away

- Have been enrolled in an FEHB plan for the five years leading up to retirement (or for your full employment period if you are retiring with less than five years of employment)

For nearly everyone under age 65, it makes sense to maintain FEHB coverage upon retirement, because you are eligible for the same great premiums. Just remember that once you unenroll after retirement, you cannot sign up for FEHB again.

When You’re 65 and Over: Medicare

Once you turn 65, you are also eligible for Medicare. Medicare is the government health insurance program for all senior citizens in the United States, regardless of where they worked, or if they worked at all. Medicare Part A provides some excellent benefits with no premiums, so it’s usually free to sign up for. Therefore, it makes sense for every federal retiree to sign up for Medicare Part A at age 65.

At that point, if you are retired, Medicare becomes your primary health insurer, while your FEHB plan is your secondary insurer. This means that your healthcare costs will first be paid out by Medicare, and if you need any additional coverage, your FEHB plan fills in the gap.

What If I’m Still Working After Age 65?

As long as you’re still employed by the federal government, FEHB will be the primary payer for your medical costs. But you can still sign up for Medicare, which could help fill in a few gaps as the secondary payer—particularly for covering deductibles and copays.

As soon as you retire over age 65, Medicare becomes your primary payer, and your FEHB coverage would cover the rest. This includes some items that aren’t covered by Medicare, such as dental, vision, and prescription drug coverage.

Should I Opt Out of Medicare Part B?

Medicare Part B functions like standard health insurance (as opposed to Part A, which is hospital coverage). Unlike Part A, it is not free—you will have to pay additional premiums to enroll. To enroll or not to enroll is a tricky question for federal retirees. On one hand, your FEHB benefits may provide all the coverage you need, and Part B would just be an extra expense. On the other, if the coverage is similar, it may make sense to compare your FEHB and Medicare Part B premiums to decide which coverage to keep.

Of course, any decision about your health insurance should be made with your personal health and wellness in mind. If you have a chronic illness or a worrying family history of medical issues in old age, you should speak with your doctor about the kinds of care you should expect to need. This is crucial information that will help you decide which medical coverage is right for you when you retire.

Pro Tip: If you want to experiment with Medicare Part B, you can sign up and suspend your FEHB coverage. Just be sure you don’t cancel your FEHB coverage, as you will not be able to get it back.

The Bottom Line

As a federal employee, you will enjoy excellent healthcare coverage during retirement through a one-two punch of Medicare and your FEHB plan. While you don’t have to worry about coverage, you should take a look at your needs to find the best possible combination of the two to keep you healthy and save you money.

While only your doctor can help you decide what care you’re likely to need, we’re here to help you crunch the numbers! As federal retirement benefits professionals, we’ve helped hundreds of federal employees develop a personalized retirement plan that maximizes benefits, minimizes worry, and sets them up for an incredible third act in life. Get in touch today for answers to all your federal retirement questions.

The Federal Employee Retirement System (FERS) provides an excellent pension for government employees, and it’s generally considered the top benefit of working in public service. Your pension even has the potential to outlive you and continue to cover your surviving spouse—but only if you navigate the survivor benefits correctly. Knowing how it all works is a crucial part of financial and estate planning for federal employees. Here’s what you need to know.

What Is the FERS Survivor Annuity?

The FERS survivor annuity is the continuation of pension payments to your surviving spouse after your death. This means that, if you die before your spouse, your spouse can receive a portion of your annual pension until their death.

If you elect a survivor annuity, you have two choices:

-

- 50% Maximum Survivor Annuity: Your annual pension is reduced by 10% while you’re alive, and your surviving spouse receives monthly payments worth 50% of your annual pension after your death.

- 25% Partial Survivor Annuity: Your annual pension is reduced by 5% while you’re alive, and your surviving spouse receives 25% of your annual pension after your death.

You can also choose to forgo the survivor annuity altogether, in which case your spouse would receive zero pension payments after your death, but your pension would not be reduced at all while you are still living. Note that this option will make your spouse ineligible for continued coverage under FEHB insurance.

FERS Survivor Annuity Eligibility

In order for your spouse to be eligible for the monthly survivor benefit, the following must be true:

- You, the federal employee, have completed at least 10 years of creditable service

- You and your surviving spouse were married for at least nine months

- Your survivor benefit has not already been designated for a former spouse by court order

Note that if you have been married for less than nine months upon your death, your surviving spouse might still be eligible for benefits if you have a child together or if your death was an accident.

The 30-Day Window

When you retire, you have a big decision to make about your pension: what, if any, survivor benefit will you choose? It’s important to know that you have only a 30-day window from your first pension payment to make changes to your survivor election. During this time, you can increase, decrease, or eliminate your survivor benefits.

If you choose to reduce or eliminate survivor benefits, you will need your spouse to sign a consent form agreeing to the change.

After the 30-day window has passed, you are strictly limited in what changes you can make to your survivor benefits. Within 18 months of your first pension payment, you can still opt in to the survivor benefit, or you can increase it. These requests will not be honored if you die before they are processed, however. There may also be additional costs involved.

The Takeaway: You can only opt out of survivor benefits within the 30-day window, so choose your benefits wisely!

Common Survivor Annuity Questions

What happens when I die?

If you have elected a survivor benefit, your spouse receives either 50% or 25% of your pension for the rest of their life.

What happens if my spouse dies before me?

If you have elected a survivor benefit, your pension reductions will stop, and you will begin to receive your full pension payment each month. You will need to present your spouse’s death certificate to the OPM to begin the process, and they will refund you any pension reductions taken after your spouse’s death date.

What if I get remarried?

Divorce and remarriage can be complex when it comes to your retirement benefits. If your former spouse has the 50% survivor benefit, your current spouse cannot receive pension benefits. However, you can still designate them as your survivor to maintain their FEHB eligibility.

If your former spouse has the 25% benefit, your current spouse could receive the remaining 25% if you elect to do so.

Note that your specific divorce settlement terms may affect these outcomes, and your situation could be different if you remarry before age 55. Consult an expert to make sure you have a full understanding of your situation.

What if I get married after I retire?

You have a two-year window after your marriage in which you can elect the survivor annuity for a new spouse. Just be aware that you will have to be married for nine months before your spouse is eligible for these benefits (though you can sign up for them immediately after your wedding).

The Bottom Line

Choosing the FERS survivor annuity is a big decision, and you can’t always change your mind. So how do you know if you should elect to cover your spouse with your pension? This discussion should be part of a comprehensive financial planning session that takes into account all of your federal retirement benefits, plus your spouse’s retirement savings. There’s no one-size-fits-all solution.

Feeling overwhelmed? We’re here to help! Get in touch to see how we can help you put together a complete, personalized financial plan for the retirement you’ve always dreamed of.

Did you know that as a federal employee, you have access to two tax-advantaged accounts to help cover the costs of your medical care?

It’s true! Federal employees can choose to open a Flexible Spending Account (FSA) and/or a Health Savings Account (HSA). These two accounts are often confused, but it’s important to understand the differences to make the most of your benefit—and not accidentally lose any of your hard-earned money. Here’s what you need to know.

What Is an FSA?

An FSA is a special account set up for you by your employer. When you choose to open one, you designate contributions to be taken directly from your paycheck and deposited into the account. You can then use your FSA account to request reimbursement for qualified medical expenses, such as prescriptions, medical and dental copays, over-the-counter medications, and certain medical equipment. The federal FSA allows you to pay your provider directly or to sign up for direct deposit for reimbursements.

The big benefit? Your contributions are taken pre-tax, so you lower your total taxable income for the year.

There are some limits and rules to be aware of, however. For 2023, you can only contribute $3,050 into a healthcare FSA. FSA funds are also “use it or lose it,” so if you don’t use all your funds for the year by the end of that calendar year, you’ll forfeit anything over the carryover amount of $610. If you have less than $610 left at the end of the year, that amount remains available to spend in the coming year, provided you re-enroll.

Pros: Tax-free contributions lowers your tax bill; many common drug store items are eligible for reimbursement, as are copays

Cons: No debit card provided; you could forfeit amounts in excess of $610 if you don’t spend it by the end of the year; you cannot use it in retirement

What Is an HSA?

Like the FSA, an HSA is a special savings account used for qualified healthcare expenses. Tax-free contributions can come directly from your paycheck, but you can also choose to add funds directly and take a deduction on your tax return instead.

One big difference is eligibility: You can only open an HSA if your health insurance policy is designated as a High-Deductible Health Plan (HDHP). It’s important to note that not every policy with a high deductible has this official designation, so you’ll have to check to see which policies qualify.

The other main difference is that an HSA is portable. You own the account forever, even if you change employers or health insurance plans. While you can only contribute to the account while you have an HDHP, you can maintain the funds and use them for medical expenses in perpetuity. That means you can also earn interest on the funds for as long as you own the account—that’s tax-free growth for the life of the account.

For 2023, the contribution limits for an HSA are $3,850 for a single person and $7,750 for a family insurance plan. There’s also a catch-up contribution limit of an additional $1,000 for anyone age 55 or older.

Pros: Tax-free contributions and growth, as long as you spend it on healthcare expenses; no carryover limits

Cons: Requires a high-deductible health insurance plan; account may be subject to management fees and limited to certain investment options

How to Choose Between an HSA and an FSA

In general, an HSA offers more flexibility and the opportunity for greater savings and tax benefits over time. Because you can keep your money growing tax-free for as long as you like, it’s potentially a great investment vehicle, especially if you’ve already maxed out your TSP contributions. The only drawback is that you must spend the money on healthcare expenses to avoid taxes and penalties. Still, the odds of you having those expenses as you age are very strong, making the HSA a great addition to your full financial plan.

To make your choice between an HSA and FSA, you’ll first have to check your eligibility. Do you have a high-deductible health plan?

More importantly, do you want one?

If you are generally healthy and aren’t in danger of meeting that high deductible, then an HDHP and HSA probably make sense for you. You might also feel comfortable with the high deductible if you have a solid emergency fund or robust savings account that you can tap into if you need to (and remember, you can use your HSA funds to cover the deductible as well).

On the other hand, if you need to access healthcare regularly and don’t have a plan to cover that high deductible, an FSA might be better for you. You can pair this benefit with an insurance plan with a lower deductible to get the great tax benefit without worrying about stretching yourself too thin if you get sick.

The Bottom Line

Both the FSA and HSA are great benefits, but you should consider your full financial picture to make the best decision. We get it—sorting through your benefits can be tricky. Sometimes you need help putting together all the pieces of the benefits puzzle. If that’s true for you, call us! We’re professionals in federal retirement and benefits, and we’re here to help you develop a solid financial plan that makes the most of everything you’ve earned.

It’s that time of year again! Whether you like to get your taxes done quickly because you expect a refund or you cringe at the thought of all the paperwork, it’s important to know what you’re getting into. There are several changes hidden in your taxes this year, from a standard deduction boost to new contribution limits for retirement accounts and more. Here’s what you need to know to make sure you’re ready to file for 2022—and a few tips for maximizing your tax savings for the coming year.

What’s New?

If you’ve been feeling the pinch of inflation, there’s at least a little bit of good news on the tax front. The IRS has adjusted both the standard deduction and the income tax brackets themselves to account for this year’s sky-high inflation. Theoretically, this should result in a slightly lower tax bill for this year, all things being equal.

Taxes are complex, and many factors will affect your personal tax rate. Here are some of the biggest changes to look out for as you prepare to file this year:

- Higher Standard Deduction: The standard deduction for 2023 is going up by roughly 7%, depending on your filing status. That means less of your income will be taxed than last year. It also means that you’ll be less likely to itemize deductions, which can save you time on your filing.

- Shifting Tax Brackets: While the marginal rates are staying the same, the IRS has adjusted the income level needed to hit each bracket. This means that more of your money will be taxed at a lower rate, slightly decreasing your tax burden.

- Gift Tax Exclusions: For tax year 2022, you could give up to $16,000 as a gift with no tax liability. For 2023, this goes up to $17,000.

- Student Loan Interest Deduction: This deduction is phased out for higher-income earners, but in 2023, you’ll be able to earn more while still getting this benefit.

- HSA Contribution Limits: You’ll be able to contribute more tax-free income to your Health Savings Account in 2023 as well, though the catch-up contribution limit remains the same.

- LTC Insurance Deductions: You’ll also be able to deduct more for long-term care insurance premiums in 2023. Exact amounts vary by age and filing status.

- Increased Retirement Contribution Limits: All types of qualified retirement accounts (401k, 403b, IRAs, etc.) will have higher contribution limits next year, as well as higher catch-up contribution limits. That means you can save more!

Looking for a cheat sheet to help you stay on top of the most important numbers? Download our 2023 Tax Guide today!

Tips to Lower Your Tax Bill This Year

If you haven’t yet filed your 2022 taxes, there are still a couple things you can do to lower your tax bill for the year.

First, remember to max out your IRA contributions. You have until April 18 to make 2022 contributions, so contribute the maximum if you haven’t already done so. If you don’t have an IRA, you could open one and still contribute for 2022—just don’t wait too long, as it may take time to process your request.

Second, be sure to review your deductible business expenses. If you have a business or side gig, much of the money you pay out to do that work is deductible—just make sure you have receipts. In particular, don’t forget to consult with your CPA or tax preparer about the home office deduction if you work from home. There’s also an enhanced business meal deduction for 2022.

Smart Moves to Make for Next Year

Though there may not be a whole lot you can do about this year’s tax bill, you can definitely plan ahead to make the most of the changes for 2023!

For starters, review your W-4 and your withholdings. If you owe taxes this year, consider increasing your additional withholding to eliminate that unhappy surprise. On the other hand, if you’re expecting a big refund, you may want to recalculate your withholdings so more of that money ends up in your pocket throughout the year—why not invest it for yourself, instead of lending it to the government interest-free?

Next, increase your contributions to your qualified retirement accounts ASAP. Don’t forget that the limits are higher in 2023, so everyone can contribute more next year. If you’re over 50, you now qualify for catch-up contributions to give yourself an even bigger boost.

Finally, think ahead about your medical expenses. If you don’t already have one, you may consider opening an FSA or an HSA. These tax-advantaged medical savings accounts can help you cover health expenses and save on your tax bill at the same time. If you have some big health needs coming up, consider planning ahead to cover them all in the same year, which could help you bundle your extra spending to hit eligibility for the unreimbursed medical expenses deduction.

The Bottom Line

Taxes are a fact of life, but it pays to make sure you’re being efficient with your money. Now that you know the numbers for 2023, you can adjust your retirement savings and tax planning to take advantage of the new rules. Not sure where to start? Talk to an expert! Tax planning can get tricky as you near retirement, and we’re standing by to help you develop a full financial plan that takes all of these moving parts into account. Get in touch to get started today!

With the new year comes a few important changes to the TSP—and understanding them will help you maximize your savings. Here’s what you need to know.

New TSP Contribution Limits

Because the TSP is a tax-advantaged retirement account, there are limits to how much you can contribute each year—the government still wants you to pay some taxes, after all! The good news is that the amount you can contribute has increased for 2023:

- Annual Elective Deferral: $22,500

- Catch-up Contributions: $7,500

Your annual elective deferral is the total amount you can contribute to your TSP for the year. This number is the combination of investments you make to a traditional TSP or a Roth TSP. You can do either or split your contributions, but the total cannot amount to more than $22,500 for the year.

Catch-up contributions are only available for people age 50 or older. You get to put an extra $7,500 into your TSP each year to give yourself a boost as you get closer to retirement. Again, this is the total across traditional and Roth contributions. Once you max out your annual deferral, the extra will automatically count as a catch-up contribution.

Pro Tip: Contribute at least what you need to in order to get your matching benefit, but do more if you can. Even a 1% increase in your contributions each year will make a difference.

Updated TSP Investment Options

When’s the last time you thought about how the money in your TSP was invested? There are five core funds, plus several Lifecycle Funds to choose from:

-

- I fund: A high-risk, international stock index fund

- S fund: A medium-high risk, total U.S. stock market index fund

- C fund: A medium risk, S&P 500 stock index fund

- F fund: A low-medium risk, broad U.S. bond index fund

- G fund: A low risk, short-term government bond index fund

- L fund: Age-based funds with a custom mix of core funds to become less risky as you near retirement.

(More information can be found on the investment options at: TSP Funds)

Over time, L funds change, and new ones are added as younger employees enter service.

The other big change? You now have the option to invest in additional mutual funds through the new TSP Mutual Fund Window. If you’re interested in broadening your options, this can be a great choice. But buyer beware: many mutual funds have additional fees and expenses.

The Bottom Line

If you haven’t reviewed your TSP investments lately, it’s time to take another look! You can get this year off to a great start by increasing your contributions and reviewing your TSP funds to make sure they are the right balance of risk and reward for your situation.

Not sure where to start? Call us! We’d love to help.

Most people don’t plan to get divorced, so when it comes, it can be incredibly stressful. In addition to the emotional strain that such a change brings, divorce is also a complex legal and financial process. Dividing up your assets fairly is a huge challenge — and it can be even more difficult for federal employees.

That’s because federal employee benefits are on the line when it’s time to split assets. But these benefits are subject to different laws, which can make crafting a divorce settlement more complex. Here’s what you need to know about how divorce can impact your federal benefits.

FERS Annuities

Your pension is one of the biggest benefits of working for the federal government. This defined benefit plan guarantees income for the rest of your life once you retire from service — and as such, it’s a valuable asset to consider in any divorce settlement. Your FERS annuity can be considered in a divorce settlement, so you could end up paying a portion of this retirement income to your ex-spouse.

For an ex-spouse to receive annuity payments from FERS, it requires a court order to have the Office of Personnel Management (OPM) make these payments. The settlement can be structured as a flat sum or a percentage of your future pension payments, but the amount can’t be greater than what you will receive after taxes and other deductions.

It’s also important to note the federal law prohibits any FERS pension payments to an ex-spouse until you retire from service. This differs from laws about non-federal pensions, which allows payments to begin once the employee reaches retirement age. You must actually retire and apply for FERS benefits to trigger payments to an ex-spouse.

FERS Survivor Benefits

Another aspect of your FERS pension is the spousal death benefit. When you’re married, your spouse is entitled to 50% of your salary plus a standard payment as a lump-sum death benefit. Your spouse may also be eligible for a survivor annuity of 50% of your pension upon your death.

When you divorce, your settlement could allow for your ex-spouse to receive this death benefit or survivor annuity—and if your ex-spouse is awarded a survivor annuity in court, your future pension payments will be reduced. This situation becomes even more complex when your and/or your ex-spouse remarries. If your ex-spouse remarries before age 55, they may lose survivor benefits eligibility. If you remarry, your new spouse is potentially eligible for these survivor benefits, but only if you elect to add them to the spousal benefit within two years of your marriage.

If this sounds complicated, it’s because it is! If you are facing a divorce, you will definitely want to seek advice from both a financial advisor and a lawyer who are familiar with all the ins and outs of federal retirement benefits to make sure you are well protected.

TSP Accounts

Another important benefit impacted by divorce is the Thrift Savings Plan (TSP). Depending on how much you contribute over the years, this account can be a significant asset. It is possible to divide the money in your TSP while you are separated and before the divorce is final if you wish. With the TSP, you are also free to change the name of the beneficiary who receives the money upon your death at any time — and you are not required to notify your spouse (current or former) of this change.

Health and Life Insurance

Once your divorce is final, your ex-spouse cannot remain on your FEHB policy for health insurance. At that point, they have a 1-month grace period to either find different coverage or elect to pay for their own FEHB policy via Temporary Continuation of Coverage (TCC) procedures. TCC only allows an additional three years of coverage though, and does not apply to separate dental and vision benefits.

For FEGLI life insurance benefits, it’s important to change the beneficiary of your policy if you do not wish your ex-spouse to receive these benefits. It is also possible for your divorce settlement to require you to assign your policy to your ex-spouse. The laws around this issue can be confusing, as state laws may conflict with federal laws governing FEGLI benefits. For this reason, you’ll want to make sure you work with a lawyer who is well-versed in federal benefits as you negotiate your settlement.

The Bottom Line

Divorce is complicated, and it is even more so when you have federal benefits to divide. There’s no rule that says you must give a portion of your federal benefits to your spouse when you divorce if you can find another way to share your assets equitably. If you do end up splitting your TSP or pension, be sure to consult with legal and financial experts to male sure you understand exactly what you’re giving up — and how it may affect you in the future.

Need more advice about your federal retirement benefits? We’re here to help! Get in touch today to learn more about how we can streamline retirement planning for federal employees.

A raise is always good news, but what can you do right now to ensure that you make the most of it? Try these ideas to stay mindful with your money in the new year.

Increase Your TSP Contributions

When’s the last time you looked at your TSP contributions? Getting a raise is the perfect time to review these amounts — and bump them up to take advantage of your extra income.

If you currently have no trouble making ends meet, consider putting your entire raise into your TSP. Raises have a tendency to disappear into thin air, with a latte here or a new pair of shoes there. Directing the funds into your TSP immediately is a great trick to make sure your money sticks around.

Pro Tip: TSP annual contribution limits may change each year. That means you may be able to save more this year than last — great news for anyone had maxed out!

Build Your Cash Reserves

Worried about inflation making everything in your life more expensive? You’re not alone. In case you missed it, inflation is up over 9.1% this year. If that keeps up, it basically wipes out your raise anyway.

If you’re feeling unsettled by that news — or by your weekly grocery bills — consider pushing your raise into an easy-to-access savings or money market account. This will ensure that you can get to your money if you need it for an emergency or for unexpected expenses, while still earning a little interest on it.

You can also designate your savings for a future purchase, like a down payment on a house or new car. Opening a secondary savings account that’s purpose-driven can help inspire you to build your balance faster — and keep you from dipping into the extra money without thinking about it.

Pay Down Your Debt

Got credit card bills to dispatch? You can also use your raise to increase your monthly payments on these bills to pay them off faster. This trick also works for paying off a car loan or mortgage. Instead of pushing your raise into savings, just add the monthly amount of your raise to one of your debt payments instead.

If paying down debt doesn’t seem very exciting, try a debt calculator to see how you can save by paying a little each month. Not a bad way to put that raise to good use, especially if you’re already maxed out on retirement account contributions.

New Year, New Goals

Using your raise well is all about staying mindful and really paying attention to where your money is going. The new year — and its new paycheck — is the perfect time to review your finances to make sure you know exactly what you’ve got coming in, and well as what your spending situation looks like.

When you get your first paycheck, take the time to review your monthly budget, reworking it to reflect your new income. Then, take an honest look at your spending and update those line items as needed. This will give you important insight so you can plan your financial year accordingly.

If that planning feels overwhelming or complex, now’s the time to work with a financial advisor to get a clearer picture of where you stand — and what action steps you should take to get where you want to go. The right financial plan will help you make the most of income today and give you peace of mind about your future retirement plans.

Need help understanding exactly how your TSP, pension, and benefits can all work together to fund your retirement? We specialize in financial planning for federal employees, and can’t wait to help! Get in touch today to learn more.

Thinking of retiring from your job as a federal worker? Congratulations! You’ve put in a long career of public service, and now it’s time to reap the rewards of that great benefits package you’ve heard so much about over the course of your career.

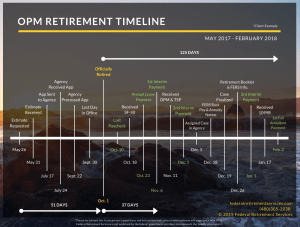

Unfortunately, you do have to jump through some hoops to complete the retirement process and receive your pension. It’s a time-consuming process — and if you’re not careful, an expensive one. The truth is that the Office of Personnel Management (OPM) has a lot of paperwork to get through, and you won’t get your full retirement payments until they review it all.

Though the OPM’s stated goal is to process retirement paperwork within 60 days, it often takes longer. Since the pandemic, the average processing time has been more like 90 days for retirees.

Why does it take so long? There are a lot of moving parts.

Your Retirement Paperwork Timeline

Submitting your FERS retirement application is only the beginning. First, your department’s personnel office will have you sign off on several documents and begin the work of verifying your service — something that can take extra time if any documentation is missing. They also transfer your life insurance (FEGLI) and health insurance (FEHB) enrollment to the OPM.

Then it’s the payroll office’s turn. When they receive your paperwork from personnel, they authorize your final paycheck and your payout of unused annual leave. They also forward records of your salary, retirement contributions, and service history to the OPM.

Once OPM finally has your full paperwork packages from these other departments, they provide you a civil service claim number to keep track of everything. And then you wait for them to review your eligibility, calculate your annuity, and — finally! — send you that check.

So how long does all of this take? Here’s the general timeline as it stands today:

- Day 1: Your retirement date. Congratulations! Throw away your alarm clock and start those hobbies you’ve been dreaming about.

- Day 30: TSP funds available for withdrawal. The payroll office will let TSP know you’re retiring automatically, and you should be able to access these savings without penalty within 30 days of retirement.

- Day 30-45: Annual leave lump sum payment sent. It takes at least two full pay periods after your retirement date to process this payment, and often up to six weeks to receive it. This is the responsibility of the payroll department.

- Day 45-70: OPM sends first retirement letters. Somewhere between six and 10 weeks after your retirement date, OPM will send you your Civilian Service Annuity Number (CSA#), which you will need any time you contact them in the future. They will later send a letter with an online password for you to use to set up future communication.

- Day 45-70: OPM sends interim retirement check. After you receive your first letters, you’ll get your first annuity check — but this will only be for 60-80% of your expected annuity. This is just to tide you over while they process the paperwork and should get to you within six to 10 weeks of your retirement date as well.

- Day 90-120: OPM sends your full retirement check. Once they finally get through your paperwork, OPM cuts you a check for the full amount of your annuity. This catches you up on what you were owed from the interim check, minus insurance and taxes. It can take three to six months for this full check to arrive.

Worth repeating: It can take up to six months before you receive your full retirement benefits. Because of this, it may be helpful to file your paperwork 60-90 days prior to your retirement date.

It’s also a good idea to have a financial plan in place to cover you while you wait for your annuity to kick in. You don’t want to fall into the OPM trap of using credit cards to get by for those months, so consider working with a financial planner to come up with a solid strategy to get you through this period.

Other Things to Remember

Although your life and health insurance premiums will eventually be deducted from your full retirement check and your coverage will continue as you await OPM processing, not all of your benefits will be covered automatically during the transition period.

If you have additional FEDVIP Dental/Vision coverage or LTCFEDS Long Term Care insurance, you’ll need to contact those providers directly to make payments while you wait for your full retirement check to be processed.

Likewise, any personal allotments you have set up through payroll will stop once you retire. You can resume these through the OPM once your final retirement check is processed.

Finally, you will no longer be able to contribute to a Flexible Savings Account (FSA) once you retire. However, you can still access any remaining balance to get reimbursed for qualified expenses you made before your retirement date.

Important Contacts

If you find that your retirement process is delayed past the dates on the timeline above, you’ll want to get proactive to find out what’s happening. You’ll also want to make sure you contact the right department for each issue you face:

Thrift Savings Plan (TSP): (877) 968-3778 or www.tsp.gov

OPM: (888) 767-6738 or www.opm.gov

BENEFEDS (Dental/Vision): (877) 888-3337 or https://www.benefeds.com

LTCFEDS (Long Term Care): (800) 582-3337 or https://www.ltcfeds.com

FSA: (877) 372-3337 or https://www.fsafeds.com

Social Security: (800) 772-1213 or www.ssa.gov

Medicare: (800) 633-4227 or www.medicare.gov

The Bottom Line

Retirement planning for federal employees can feel overwhelming, but if you start early, you can make sure your paperwork is flawless for easier processing. You’ll also need to make sure you have a plan to cover your expenses while you wait for the OPM to process your paperwork and send that first full check.

We’re here to help! We’re experts in the federal retirement system and can help you develop a wealth management plan that will let you enjoy your first days of retirement instead of running to the mailbox every day to look for that check. Get in touch to get started today.

Life insurance can be a tricky subject. For starters, no one likes to talk about it — after all, discussing your own death isn’t exactly a fun conversation. Still, it’s incredibly important to take the time to figure out how much your family could lose if you died unexpectedly — and then take steps to get the right life insurance coverage to protect them.

As a federal employee, you’ve got some great options for life insurance as part of your benefits package. The Federal Employees’ Group Life Insurance (FEGLI) Program covers about 4 million people and the government picks up a third of the tab for Basic coverage, making it a great financial deal.

But is the Basic plan enough? Here’s what you need to know to make sure your family is protected.

FEGLI Basics and Options

Nearly all federal employees are eligible for FEGLI coverage, and you are automatically enrolled in the Basic plan when you are hired. That means that your cost comes out of your paycheck, and you probably won’t even notice.

Basic FEGLI coverage will pay your designated beneficiary one full year’s salary plus $2,000 when you die. However, there is an extra benefit for younger employees. If you are age 35 or under at the time of your death, the FEGLI benefit is 200% of your annual salary. Between the ages of 35 and 45, this extra benefit decreases by 10% each year until it disappears at age 45. At that time, you’re back to the standard benefit of 100% of your salary.

If you’d like to provide more for your family, there are three optional FEGLI plans to consider:

- Option A: Pays out an additional $10,000 upon your death.

- Option B: Pays out an additional multiple of your annual salary. You can choose coverage from 1 to 5 times your annual income.

- Option C: Pays out up to $25,000 for the death of a spouse and up to $12,500 for the death of a child if you choose to cover immediate family members.

It’s important to note that you’ll be paying the full premium for any additional coverage you choose: the government doesn’t subsidize FEGLI options, only the basic coverage.

The cost of optional coverage also rises as you get older. By the time you are in your 60s, the premium will be more than 10 times what you paid when you were 30, so it’s a good idea to review your financial plan regularly to make sure you aren’t paying for coverage you no longer need as you get older.

How Much Life Insurance Do You Need?

This is a highly personal question, and a tailored answer will depend on many factors, including your age, your assets, the size of your family, whether you’re their primary source of income, and more. But in general, you can get a sense of your family’s needs by looking at your annual income and expenses.

For starters, how much money would your family lose if you died, and how many years of replacement income would they need? One easy calculation is to take your annual income and multiply it by the years you have until retirement. This amount would provide your surviving family members the money you would have provided until you stopped working.

But this might be more money than your family actually needs. If your house is paid off, you have no debt, and your spouse is working full time, full income replacement probably isn’t necessary. So as you fine-tune your number, consider how much your family may require. You can get an idea based on your annual spending right now, but make sure to consider additional expenses such as:

- Childcare costs

- College costs

- Mortgage payoff costs

- Consumer debt

- Funeral costs

- Health insurance costs (if your family loses coverage when you die)

Once you have a good idea of how much your family would need to survive without your income, you’ll need to decide how long they’ll need any replacement income to last. If you have young children, you’ll want to multiply their annual “need number” by as many years as your children will need support. For most people, that’s until they graduate from college at age 22 or so.

How to Get Help When You Need It

If this feels overwhelming, you’re not alone! It can be very challenging to estimate your family’s need when so many unknowns will affect the equation. Fortunately, a life insurance calculator can help take some of the guesswork out of your calculations and give you a better sense of the right amount of coverage for your family. It’s also a great way to fine-tune your coverage after major life events and as your needs change based on age.

When you begin to run the numbers, one thing is clear: most people will need more than just FEGLI Basic coverage to help their loved one through a difficult time. One year’s salary may simply not be enough. If that’s the case for you, explore your FEGLI options and comparison shop private rates as well.

Finally, if you need additional help deciding what coverage is right for you, please get in touch. Life insurance is just one part of a comprehensive financial plan, and we’re here to help make sure you’re on the right track for a good life and a great retirement. Contact us for more help navigating your federal benefits today.

The whole point of a Thrift Savings Plan (TSP) is to put away extra money, little by little, to add up to big savings by the time you retire. When it comes to retirement savings, the first rule is not to touch that money until you retire, no matter how tempting it might be to dip into those funds for other purchases (or in case of emergency).

That’s sound advice, but there are exceptions to every rule. When it comes to the TSP, did you know that you’re allowed to take money out — penalty-free! — before you retire? And that it can actually be a good idea under the right circumstances?

Welcome to the wonderful world of age-based withdrawals. Here’s what you need to know to make them work for you.

What Is an Age-Based In-Service Withdrawal?

Generally speaking, your TSP money is off-limits while you’re still working in your government position. However, an age-based in-service withdrawal allows you to take money out of your TSP while you’re still working as long as you have reached age 59½.

In addition to being old enough to qualify, you also need to meet a few additional requirements:

- You can only withdraw from funds in which you are fully vested (i.e., you have enough years of service to do so).

- You must withdraw at least $1,000.

- If you have less than $1,000 in your TSP, you must withdraw the entire amount.

- You can make a maximum of four age-based withdrawals per year.

What’s the Catch?

Keep in mind your withdrawal is subject to a 20% federal income tax unless you roll it over into another eligible retirement plan such as an IRA.

So if you plan to spend the money, you’ll be taxed on the portion that came from traditional TSP funds, but not Roth funds.

On the other hand, you have the opportunity to roll your TSP funds into an IRA account totally tax- and penalty-free.

Change your mind after you have moved money into an IRA? You can move your money back to the TSP as long as you keep your account open by maintaining a minimum balance.

What’s the Advantage?

The TSP is a great benefit, but your investment options are pretty limited. Right now you can only choose from five different index funds, and you’re stuck managing that money yourself. This means that when you retire, it will be all on you to make sure your investments are well-balanced and that you time selling shares and taking distributions to minimize your taxes and make sure your money is invested as wisely as possible.

That’s a tall order, especially if you’d rather relax during your retirement than worry about your money.

If you roll over your TSP funds into a private IRA, though, you can let an investment fiduciary take charge of managing your money. For many people, this comes as a huge relief. It allows you to streamline your retirement management and get great advice so you don’t have to worry about your TSP money in an economic downturn. It also gives you the freedom to invest in a much broader range of ETFs, mutual funds, stocks, bonds, annuities and more — anything that you and your advisor decide is right for your plan is now available outside the confines of the TSP.

An age-based withdrawal also provides you the opportunity to convert a traditional TSP to a Roth IRA. A Roth conversion will require you to pay taxes on the money you roll over, but once you do, you’ll never have to pay taxes on it again. Additionally, Roth IRAs are not subject to Required Minimum Distributions (RMDs) once you reach age 72. This is a huge advantage for anyone who is happy to live on their pension and would like to keep their IRA intact to pass on to their heirs — or just to keep it for as long as possible before spending it down.

What’s Next?

To make an age-based in-service withdrawal, you’ll need to log into your TSP account and click on the withdrawals section. From there, you can complete your request for the withdrawal online. Funds are delivered via direct deposit, electronic transfer, or paper check. From there, you can transfer the money to your IRA — just make sure to hang onto the paperwork as you do so to show the IRS that your withdrawal was actually a rollover.

Age-based withdrawals are often a “hidden” benefit of TSPs, and many people never take advantage. If you’d like to learn more about rolling over your TSP funds into a professionally managed IRA or making that Roth conversion to avoid RMDs, we’re here to help! Please get in touch to learn more about our specialized financial planning for federal employees today.