What is Medicare IRMAA? How to Avoid an Expense Surprise

Medicare is a fantastic benefit that makes it possible for many retirees to enjoy life more fully, thanks to premiums that are far more affordable than market rates on private health insurance plans. Still, Medicare isn’t free, and there are some sneaky extra costs that can blindside you if your income rises above a certain threshold.

Friends, meet IRMAA.

Just as a sudden windfall or boost in your retirement income can bump you into a higher tax bracket, so too can it push you into a higher payment tier for your Medicare Part B and Part D coverage.

Fortunately, unplanned IRMAA expenses can be avoided with careful planning. Here’s what you need to know.

Understanding IRMAA

IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some people’s Medicare premiums. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage.

IRMAA charges affect premiums for Medicare Part B (medical insurance) and Part D (prescription drug coverage) plans. If you have a Medicare Advantage plan, you will also be subject to IRMAA charges on the affected portions of the plan.

IRMAA charges are based on your yearly income as reported on your tax return. Specifically, the Social Security Administration (SSA) uses your Modified Adjusted Gross Income (MAGI) for its calculations.

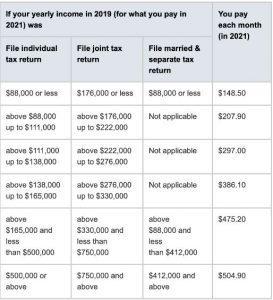

For this year, anyone earning less than $88,000 filing single or $176,000 filing joint will not have an IRMAA charge: your monthly premium is the standard $148.50 per person, per month.

However, if you earn more than that, you will be charged extra based on your income bracket:

Source: medicare.gov

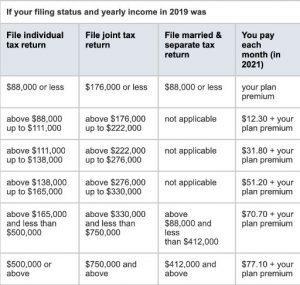

Likewise, you will also be charged extra for Part D coverage, following the same income brackets:

Source: medicare.gov

Why IRMAA Can Be Tricky

When the SSA determines your IRMAA charges, they use your MAGI from two years prior to the year in question. For example, premiums for 2021 are based on the income from your 2019 tax return.

This means that decisions you make could come back to haunt you in the future.

For example, if you sell some real estate and earn a profit, that money could push your income into a higher tax bracket and a higher IRMAA bracket. While you’ll pay income taxes on the proceeds relatively quickly, the IRMAA charges will be delayed, which leaves you open to a budget shortfall if you’re caught off-guard.

The income thresholds for IRMAA brackets are also subject to change each year, making it harder to plan ahead. That’s because IRMAA thresholds are no longer frozen but instead tied to inflation using the Consumer Price Index. You can make an educated guess about next year’s premiums and IRMAA thresholds before official numbers are published, but you’ll want to pad this number to avoid an unpleasant surprise.

Finally, major life events can have a big impact on your income, and this can in turn affect your IRMAA charges in the future. Fortunately, the SSA will consider an appeal if your circumstances have changed and your income is significantly lower than it was in the tax year used for your determination. Not everything that impacts your income is officially recognized, but these events could help your appeal:

- Death of a spouse

- Divorce or annulment

- Loss or reduction of a pension

- Loss of property that generates income

- Marriage

- Settlement payments from an employer

- Unemployment or reduced hours/income

Tips for Avoiding an IRMAA Charge

In general, the best way to avoid unwanted IRMAA charges is to make sure your income remains steady throughout retirement. This means remaining just as vigilant about your IRMAA bracket as you are about your marginal tax rates. This is especially important if your income hovers near the top of your current bracket, as you will have less room for error.

Some common income-boosters to be aware of include:

- Selling real estate, especially if you’ve owned it for a long time and it has significantly increased in value.

- Selling investments subject to capital gains taxes. These transactions typically occur outside of your IRA or 401(k) in brokerage accounts.

- Converting a traditional IRA to a Roth, which leaves you open to a big tax liability and IRMAA charges on the lump sum, which is considered income.

Another common income-booster comes when you turn 72 and must take required minimum distributions (RMD) from a traditional IRA, 401(k), TSP. If you plan carefully, you can reduce other portions of your income so this balances out, or you can consider giving your RMD to charity if you itemize deductions.

Feeling a little dizzy from all the things you have to keep track of in retirement? Get in touch today to learn more.