How Feds Can Avoid Overpaying for Life Insurance

Protecting our loved ones from financial burden and hardship is understandably a high priority for many folks. A lot of times this is accomplished through the use of life insurance. The key is to establish the appropriate amount of coverage to protect your family, then research the most cost effective way to provide that safety net.

The Federal Employee Group Life Insurance (FEGLI) Program offers four different options to choose from: Basic, Option A, Option B and Option C. The Basic coverage is the only option newly, eligible employees are automatically enrolled in unless they waive coverage. Alternatively, the remaining three coverages must be elected.

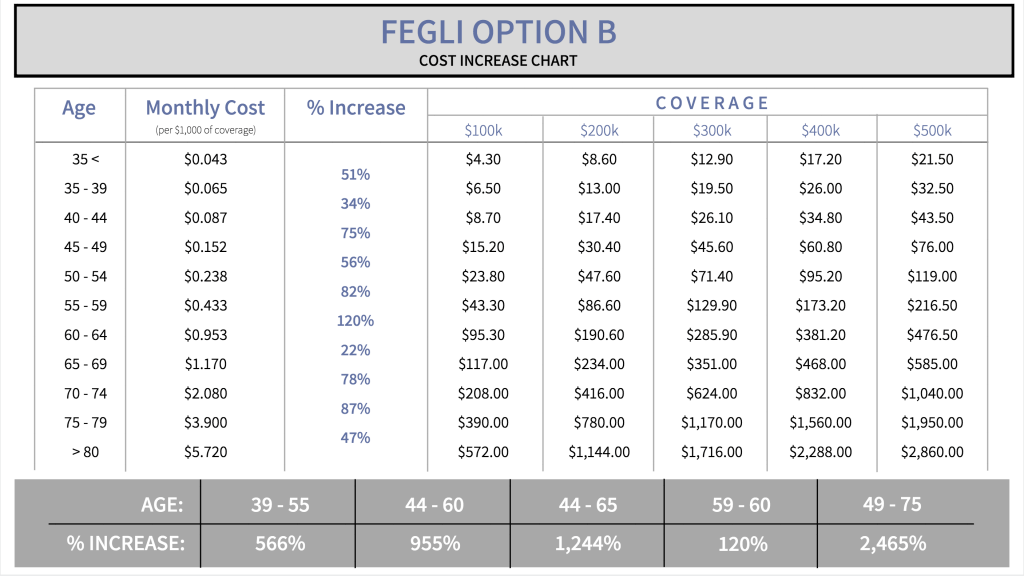

While Option B allows for the most coverage, it is also potentially the most costly option. Many people realize FEGLI Option B premiums do increase over time but they may not grasp the significance of the increase. For example, from age 44 to age 65 the premiums for FEGLI Option B increase by 1,244%.

The chart below shows the increase in FEGLI Option B premiums as well as how much you would pay on a monthly basis for various amounts of coverage:

So how do you avoid paying too much for your life insurance?

Establish the Right Amount of Coverage

Too often, people select an arbitrary figure for life insurance coverage ($250,000, $500,000, $750,000, etc.) without putting much thought into it. Maybe it’s just enough to pay off mortgages and other debts. However, the reality is that’s just the beginning of the assessment.

Take into consideration your family’s income needs, current investments, inflation, education needs (if you have children), survivor benefits from a pension and current in-force life insurance. Of course, you want to maintain the same lifestyle for your family, but you also don’t want to over-insure. Find the happy medium.

You can use an online tool to help you establish the appropriate amount.

With FEGLI Option B, you have the ability to select 1, 2, 3, 4 or 5 multiples of your salary rounded to the next $1,000. This means you have the opportunity to get as close as possible to your target coverage amount but it may be difficult to get the exact amount of coverage you need. The alternative is private level premium term life insurance where you can select the exact dollar amount of coverage.

Do Your Research

The biggest issue with FEGLI Option B is the extreme premium increases over time. The increase occurs every five years; more specifically, every time you have a birthday ending in 0 or 5. It’s hard to imagine, but the premiums increase over 2,400% from age 49 to 75 which means they become extremely high the older you get.

If you aren’t aware of these increases, you may inadvertently miss the opportunity to plan ahead and lock in lower rates with term coverage. In some cases, you may even receive a medical diagnosis causing you to be uninsurable. Essentially, you would be stuck paying high premiums and this could cause your household financial hardship in order to keep your family protected.

Good news is this is certainly something you can and should avoid.

The best way to avoid overpaying for life insurance is to do your research. Term life insurance offers the opportunity to lock in low-level premium payments that will last however many years you choose (15, 20, 25 or 30 year terms). Make sure you only shop A-rated insurance carriers and make yourself aware of any optional riders you can add to the policy – Accelerated Death Benefit / Critical Illness rider, Child rider, Spouse rider, Premium Waiver rider and Return of Premium ride, etc. You may opt to add one or more or you may find them unnecessary.

When it comes to getting life insurance, the sooner you get covered the better. If you have people that depend on you financially, start doing your research now and run a life insurance needs calculator. Typically, the entire process for getting private life insurance takes 30 to 60 days from application to approval, so it’s best to get a head start. I always recommend getting quotes from at least 3 to 4 different carriers, so you can compare your options and make sure you get fair pricing on your insurance coverage.

If you’d like to discuss your options with a federal retirement advisor, book a call using this link and we’ll be in contact with you shortly.