Did you know that the Thrift Saving Plan is about to change? 2022 is poised to bring about significant adjustments for federal employees. While the new rollout isn’t ready yet, the latest reporting has these changes coming your way midway through 2022. TSP updates are still several months off, but it’s never too early to plan. Here’s what we know so far.

The New Mutual Fund Window

As a current TSP holder, you’re probably well aware of the limited investing options you have in this fund. Right now, there are just five options:

- C fund: An S&P 500 index fund

- S fund: A total U.S. stock market index fund

- I fund: An international stock index fund

- F fund: A broad U.S. bond index fund

- G fund: A short-term bond index fund

You can also choose from a series of L funds that automatically allocate your money among the above five funds and reduce your risk as you age. These funds are tied to the anticipated decade of your retirement (2030, 2040, 2050, and so on). More information can be found on these options at the TSP website www.tsp.gov/funds-individual/.

But later this year, the TSP will add a new mutual fund window, which is expected to offer 5,000 new mutual fund investment options for TSP investors. This is an enormous change, and one with the potential to provide investors exponentially more freedom to invest as they see fit.

For example, it’s expected that many of these new mutual funds will provide ESG (environmental, social, governance) offerings to investors. These funds are built to help investors make socially conscious choices with their money (i.e. avoiding fossil fuels and the like).

But there is an important caveat here. More choice also means more risk, and actively managed mutual funds tend to be more volatile than index funds like the ones currently available in the TSP. That’s because index funds are designed to mirror the market overall, while other mutual funds actively try to time the market for bigger returns. If you find yourself uncertain about your new options, it’s best to consult with an expert.

What We Don’t Know Yet: It’s not yet clear whether there will be any limits on the dollar amount or percentage of investments that can go toward this new window, or if there would be any additional fees for the new investment options.

New Management of Old Funds

There are also investment management changes coming to the old fashioned TSP funds as well. Instead of being managed by a single company, the C, S, I, and F funds will now have a primary and secondary manager. BlackRock will take charge of 80% of these funds assets, while State Street will be responsible for the other 20%. This is to reduce risk across the board.

It’s important to note that in this case, risk isn’t to the money in the fund, but is more about operations. For example, if one company experienced downtime or delays that took them off line for a few days, TSP investors wouldn’t be left entirely in the lurch. This is all pretty deep into the inner workings of the TSP, and the average investor would never notice this change.

Modern Upgrades and Features

Finally, the changes to the TSP are designed to bring service into the twenty-first century. Here are some of the features expected to launch this year, thanks to a new vendor coming on board:

- A mobile app for smartphones

- Customer service online chat

- Virtual assistant powered by AI

- Online forms

- Electronic signatures

- Concierge service for common issues

- Increased security and fraud protection

- Biometric data (thumbprints and facial recognition) to log in

- Updated record keeping

Any time your retirement savings plans change, it’s a good time to review your investments to make sure they’re working for you. Whether you’re wondering how to pick the best new mutual funds or need help developing an investment strategy that balances risk and reward, we can help. Get in touch for help with your federal retirement benefits today.

Federal employees enjoy some of the best benefits packages around. In addition to a robust pension plan and health insurance to name a few, you also have the option to invest in a Thrift Savings Plan (TSP) to help fund your retirement.

Whether you’re a new employee or have been working government jobs for years, it’s always a good idea to review your TSP contributions and allocations to make sure you’re investing your money in the ways that will work best for you. Here’s what you need to know.

TSP Basics

When you begin your first eligible job at a government agency, you are automatically enrolled in the TSP plan, and 5% of your salary is pulled out of your paycheck to fund the account. This is the minimum amount you can contribute to remain eligible for matching funds from your agency. That’s free money, and it can make a real difference over time, so it’s a good idea to maintain this minimum contribution to take advantage. You can also increase your contributions at any time if you’d like to save even more.

Your TSP account functions like a 401(k) in the private sector and is subject to many of the same rules. For example:

- Unlike a standard brokerage account, the TSP is a tax-advantaged account that lets your money grow tax-deferred or tax-free if the Roth TSP is selected.

- There’s an annual maximum contribution limit of $20,500.

- If you’re age 50 or older, you can contribute an additional $6,500 each year as a “catch-up” contribution.

- TSP funds can be designated as Traditional or Roth contributions.

- You can begin to take distributions from your TSP account at age 59½ without penalty.

- You must begin taking required minimum distributions by age 72.

TSP Investment Options

One way in which the TSP differs from a 401(k) or IRA is the way in which you can invest your money. Instead of having unlimited mutual funds and investment vehicles to choose from, this government-sponsored plan has just five individual funds to choose from and several L Funds.

C Fund

The C Fund is the Common Stock Index Investment Fund, which is an index fund designed to match the performance of the S&P 500. This means that when the 500 companies in the S&P 500 do well, your investment gains money. You may also lose money if this index drops in value. Investing in the stock market always comes with some risk, though this fund’s focus on well-established U.S. companies mitigates that risk somewhat. The C Fund is considered a medium risk investment.

S Fund

The S Fund is the Small Cap Stock Index Investment Fund, which tracks the performance of the Dow Jones Industrial Average. This fund covers a broader range of domestic stocks, so while the fund is well-diversified, it also comes with greater risk. The S Fund is considered a medium-high risk investment.

I Fund

The I Fund the International Stock Index Investment Fund, which consists of stocks from Europe, Australasia, and the Far East. Investing in international stocks adds plenty of diversity to your portfolio, but also greater volatility. The I Fund is considered a high risk investment.

F Fund

The F Fund is the Fixed Income Index Investment Fund, which is a bond fund. Because bonds are generally backed by government entities, they are much safer investments. You won’t generally lose money in bonds, though the rate of return is often lower than the rate of return in the stock market. The F Fund is considered a low-medium risk investment.

G Fund

The G Fund is the Government Securities Investment Fund, which invests in short-term U.S. Treasury securities. Because these bonds are backed by the U.S. government, they are a very safe investment. When interest rates are low, the rate of return isn’t great, but it’s very reliable. The G Fund is considered a low risk investment.

L Funds

The L Funds are Lifecycle Funds that are designed to take the guesswork out of investing. These funds automatically divide your contributions among the five funds listed above, allocating your investment in a way that makes sense for your age. You simply choose the fund with the year closest to your target retirement rate, and the fund manager adjusts your allocations so that the fund becomes less risky as you age.

Choosing Your Allocations

Employees are automatically enrolled in an L Funds to begin, and it’s an easy way to manage your investments — you don’t have to worry about changing your allocations, as this is done automatically over the years.

However, if you would like to exercise more control over your investments, you can choose to divide your contributions among the other funds listed above. Because stock investments generally have a far greater rate of return than bonds, you’ll want to have at least some of your money in the stock market to allow your wealth to grow. But finding the right balance is key: if all your eggs are in one basket and the stock market crashes, your retirement could be at risk.

In general, younger people invest more heavily in stocks because they have many years to ride out the risk. Over time, the balance between stocks and bonds should be adjusted to rescue risk as you get closer to retirement age.

Of course, some people have very low tolerance for risk, while others can stomach the ups and downs of the market just fine. Consider taking a risk tolerance assessment to get a sense of your comfort zone when it comes to investing.

If you’d like to learn more about the best allocation of your funds to meet your personal goals, we’re here to help! Contact us today to walk through your TSP investing options and develop a wealth management plan that’s right for you.

If you’ve heard it once, you’ve heard it a thousand times: “Wow, you work for the federal government? Must be nice to have such a great benefits package!”

What people outside of public service don’t realize is that those great benefits come with a few strings attached — namely, the fact that sometimes you have to navigate some bureaucracy to access all those benefits.

This is particularly true when you’re ready to retire. Retirement isn’t just something you can decide to do one day and expect everything to fall into place in a few weeks. To maximize your benefits — and even just to get your pension payments in a timely fashion — you need to plan ahead.

Here’s what you need to know to avoid falling into the OPM Trap.

OPM Retirement Basics

The OPM is the Office of Personnel Management, and they hold the keys to the kingdom when it comes to getting your pension payments. This is the massive human resources department for all federal employees, so you’ve almost certainly dealt with them at some point during your career.

When you’re ready to retire, there are plenty of forms to fill out and decisions to make. To ensure that you have time to get all your financial ducks in a row, the OPM encourages federal employees to begin retirement planning as early as five years ahead of their proposed retirement date. Getting an early start lets you:

- Plan ahead to maintain your FEHB health insurance for the five-year period before you retire, so that you can continue coverage into retirement before Medicare picks up the slack

- Plan ahead to maintain your FEGLI life insurance coverage

- Gain a clear understanding of your FERS Annuity (aka pension) eligibility and how your TSP retirement funds, annuity, and Social Security checks will work together to fund your retirement

When you get to a year out from your desired retirement date, it’s time to get serious about planning and applying. At this point, you’ll need to:

- Review your Official Personnel Folder (OPF) to check dates or service, raises, and more for accuracy

- Tell your supervisor about your plans

- Choose an official retirement date

- Attend a pre-retirement counseling session to understand your benefits and the process

- Elect survivor benefits

- Get an annuity estimate to help you with your planning

Finally, you should apply for your FERS Annuity at least 2 months ahead of your planned retirement date. This allows time for your personnel office to review your files and complete their own round of paperwork verifying your service — this goes faster when your OPF has already been reviewed and is in good order. Your payroll office also has forms to complete, and then they will finally send your application off to the OPM. This all takes time, but the sooner you complete your paperwork, the sooner these offices can complete theirs.

When the OPM receives your file, they will send you a civil service claim identification number for reference — don’t lose it! It’s how you’ll be able to track progress and get any questions about your pension answered.

The OPM Trap

Once the OPM has your application, approval isn’t exactly instantaneous. They have to review all of the submitted paperwork, calculate your FERS Annuity, and finish final processing. This can take a long time.

Though the OPM’s stated goal is to process pension applications within 60 days, the reality is that it usually takes much longer. In July of 2021, average processing time was over 90 days. Since that’s an average, it’s possible that your application could take anywhere from two to six months to complete — or even up to a year.

So what’s the OPM trap?

While you wait for your pension to be fully processed, you aren’t receiving your full pension. Instead, you receive an interim payment, which can be anywhere between 60 and 85% of the actual value of the FERS annuity you’ve earned. These checks begin coming your way within 6 to 8 weeks after you retire.

The OPM trap gets people when they retire without realizing that their full pension checks could be many months away. First, you’ll wait for up to two months without any pay until your interim check comes through. Then, you’ll wait several more months with partial pay until your pension is finalized.

If you don’t have a plan in place to get you through this dry spell, the OPM trap can be a painful reality check on your first year of retirement.

Strategies to Cover the Interim Payment Period

Clearly, you need to have some cash reserves saved up and ready to go to get you through this period of partial annuity checks. This is definitely a “better safe than sorry” situation.

There are several ways to do this:

- Savings accounts and money markets: A simple, easy-to-access savings vehicle may be all it takes to see you through, especially if you began planning for the OPM trap a few years in advance.

- Your traditional TSP account: If you retire in the calendar year you turn 55 years old, you can begin to take distributions from your Thrift Savings Plan. This is money you’ve been saving for retirement, so it may make sense to begin accessing it while you wait for your pension to be complete.

- Annual Leave Lump Sum Payment: One of the best ways to keep cash on hand as you wait for your full pension is to use your Lump Sum Payment of Annual Leave. You’re entitled to be paid for your unused leave time at your regular hourly rate, so this can be a great windfall that gives you cash without forcing you to raid your other accounts. This check usually arrives within a month of your retirement. Keep in mind that annual leave lump sum payment will have taxes withheld.

In fact, you can plan ahead to maximize your annual leave payment by taking fewer or shorter vacations in the last years before retirement.

Pro Tip: Retiring on December 31 will ensure that your lump sum check comes in a fresh tax year, which may help reduce your total taxable income for your final year of employment.

The OPM Trap is real, but it doesn’t have to derail the beginning of your retirement. When you plan ahead for a long delay, you’ll ensure that you can sail through the waiting period without too much trouble. And if you’ve over prepared, and your interim payment period is shorter than expected, even better!

Need help with your retirement planning? We can help! Federal benefits and retirement planning is what we do, so contact us for a consultation today.

Financial planning is a life-long endeavor, and there’s more to it and then just retirement. You also need to take into consideration your health and your quality of life. As people live longer, that means planning for many more years of life — years that could potentially be spent in decline.

No one likes to think of losing their independence, but most people will, at some point, require long-term care. These services can be in-home care provided by family, visiting nurses, or other caregivers, or these services can be provided by part- and full-time assisted living facilities.

Long-term care is very expensive, and it’s not covered by medical insurance or Medicare. It is covered in some states by Medicaid, but that’s only available after you’ve spent all of your assets and are in desperate need.

So how should you go about planning for your long-term care needs? Federal employees have an important benefit available, but it’s not necessarily a great choice for everyone. Here’s what you need to know.

The Federal Long-Term Care Insurance Program

The Federal Long-Term Care Insurance Program (FLTCIP) is a special insurance program available to federal employees as well as active or retired military personnel. The FLTCIP covers payments to nursing homes and other services related to long-term care, either in or out of your home. Rates are based on several factors, including:

- Your age

- Daily benefit amount (i.e., how much your policy will pay for each day you require care)

- Benefit period (i.e., how many years of care your policy covers)

It’s important to understand that the FLTCIP is a use-it-or-lose it program: If you don’t end up needing long-term care in your lifetime, you will lose the money you paid out in premiums. Therefore, choosing the right amount of coverage is crucial so you don’t overpay. You’ll need to carefully research long-term care costs in your area and understand your needs. For example, women tend to live longer and spend more time in long-term care than men, and your health conditions can offer a clue about your future needs.

It’s also important to note that the premiums for the FLTCIP can increase over time as the cost of care rises. You’ll want to plan ahead for these increases so you’re not blindsided by them in years to come. Likewise, you’ll want to consider the impact of inflation on your coverage and adjust your policy as needed. The FLTCIP offers an automatic inflation adjustment option, or you can opt in to future increases.

To better understand all of your options within the FLTCIP system, check out these informative webinars.

Weighing All Your Options

As a federal employee, you’re probably used to having your benefits ranked among the best in the country. However, you should definitely shop around when it comes to choosing long-term care (LTC) coverage.

Private LTC insurance often takes into account sex as well as age, because women tend to need more long-term care than men. For this reason, women will often pay higher premiums. Because FLTCIP doesn’t take sex into account, women may be able to get a great deal through the federal program, while men can often save money by shopping around.

Private LTC insurance and FLTCIP coverage can both hike premiums over time, leaving you short on cash if you’re not careful. For this reason, you may prefer alternative coverage for long-term care planning:

- Shared LTC Plans: These options allow spouses to pool their LTC coverage. Spouses apply at the same time and can share benefits. This helps alleviate the “use-it-or-lose it” problem, as a surviving spouse can still access remaining benefits for the rest of their lifetime.

- Hybrid Life Insurance/LTC Plans: This type of coverage combines a whole life insurance plan with LTC coverage. Your premium provides a long-term care benefit and a death benefit, so you don’t lose the value of your premiums if you never need long-term care. Hybrid plans are attractive because premiums don’t go up, but LTC coverage is often less flexible and more expensive than a pure LTC insurance plan. It also provides a death benefit to your heirs.

- Long-Term Care Riders: Some whole life insurance policies offer additional riders that allow payouts for long-term care. These payments will likely reduce the death benefit to your heirs but can be a helpful option if you’re looking to avoid rising premiums.

- Self-Insurance: If you’ve been saving diligently for your retirement and have taken advantage of your other federal benefits, you may be able to afford your long-term care needs on your own, without the additional expense of insurance. Your Social Security income, pension, and TSP savings may already provide sufficient coverage. You may also already have a life insurance policy with accelerated death benefits that allow you to tap into your benefit while you’re still alive to pay for medical expenses.

Before choosing any LTC insurance option, run the numbers. A thorough needs assessment will help you calculate the cost of long-term care in your area and show you several different scenarios based on how long you need care. From there, you can review your savings and investments to see if you can afford the costs outright or if additional insurance coverage is right for you.

Long-term care is expensive, but so is LTC insurance. You don’t want to pay for coverage you don’t need, so don’t assume that the FLTCIP is automatically right for you. An alternative plan could save you money while providing substantial peace of mind.

If you’d like help planning for your future, we’re here for you! Get in touch today to discuss your options and come up with a plan that works for you and your family.

Federal employees have a whole raft of benefits that touch on everything from retirement savings and pensions to health, life and long term care insurance. But what happens to those benefits when you die? No one likes to think about death, but it’s crucial that you know how your benefits will be distributed to your surviving spouse or children. If you plan carefully, you can leave loved ones a gift of lasting security.

Here’s what federal employees need to know about survivor benefits for spouses and children.

Thrift Savings Plan

The Thrift Savings Plan (TSP) is a defined contribution retirement account for federal employees. It has the same basic tax advantages as a 401(k) in the private sector, and you also receive matching funds from your agency while you are working.

When you die, your TSP account will pass to your designated beneficiary, which you must name on a TSP-3 Beneficiary Election form. If you designate your spouse, they will be able to keep the account open and use it for retirement just as you would have, with all the same rules and benefits. Any other beneficiaries, such as your children or grandchildren, would have to close the account and transfer the funds into an IRA. Adult children will want to review the recent Secure Act changes to beneficiary/inherited IRAs. Rather than being able to distribute inherited IRAs for their lifetime, adult children will need to deplete the IRA by the end of the 10th year following the passing of their parent. The 10 year clock doesn’t begin for minor children until they reach age 18.

If no beneficiary is named, the account will be closed and funds given to the first person in line in the standard order of precedence. The surviving spouse is first, followed by children if there is no surviving spouse then parents.

FERS Survivor Benefits

The Federal Employee Retirement System (FERS) is a defined benefit plan that pays out a pension upon retirement. This is an annuity that provides an annual payment of a certain percentage of your most recent salary, depending on your age and years of service in a federal job.

There are three types of survivor benefits connected to your FERS account, each with different guidelines:

Basic Death Benefit

When a FERS employee dies, the surviving spouse is eligible for a lump-sum death benefit equal to 50% of the deceased’s current salary plus a one-time payment of $34,991. (Note that this is the approved amount for 2021, but it’s adjusted annually for inflation.)

To be eligible, you must have 18 months of creditable service, and your surviving spouse must have been married to you for at least nine months OR be the parent of a child born during your marriage (even if the child is born after your death). If your death is the result of an accident, these requirements are waived.

Survivor Annuity

Provided the surviving spouse meets the eligibility requirements above AND the deceased federal employee had 10 years of creditable service, they are also eligible for an annual benefit based on the deceased’s pension schedule. This benefit is 50% of the federal employee’s annual pension, with no reduction for age made if they died before retiring. This amount is adjusted for inflation each year.

The survivor annuity may also be paid out to children of the deceased, as long as the federal employee had 18 months of creditable service. Eligible children must meet the following criteria:

- They are unmarried

- They are claimed as dependents

- They are under age 18, or under age 22 if attending college full time

The age requirement is waived for unmarried, disabled dependents, provided the certified disability occurred before the age of 18.

Note that children’s benefits are reduced by the amount of Social Security survivor’s benefits they are entitled to. In many cases, this cancels out the FERS benefit.

Lump-Sum Benefit

If a federal employee dies and no one is eligible for a survivor annuity based on the factors listed above, survivors are entitled to a refund of all the money that was contributed to FERS during the deceased’s service, plus interest.

If this occurs, the lump-sum is paid to the designated beneficiary. If there is no designated beneficiary, the money is paid first to the surviving spouse, and then to children if there is no surviving spouse.

FEGLI Benefits

Federal Employee Group Life Insurance is an additional benefit that provides life insurance to federal employees. These benefits are designed to be paid out when you die, so the survivor benefits are much more straightforward. All funds are distributed to your designated beneficiary upon your death.

If there is no named beneficiary, the funds are given first to the surviving spouse, next to surviving children, then to surviving grandchildren, and finally to surviving parents of the deceased.

FEHB Benefits

The Federal Employees Health Benefits program is the health insurance plan for federal employees and their families. When a federal employee dies, surviving family members covered under the Self and Family plan can continue their coverage as long as they are eligible for a FERS Survivor Annuity. If you have a Self Plus One plan, your designated family member can continue coverage if they meet the same requirements.

If you have a Self Only FEHB plan, there are no survivor benefits when it comes to healthcare, though your spouse and children may qualify for a Temporary Continuation of Coverage (TCC).

Social Security

The Social Security Administration also provides benefits to survivors. It can be easy to lose sight of your Social Security eligibility in the midst of all the other benefits, but it’s also important. To be eligible for survivor benefits, you will have to have earned a certain number of work credits based on your age at the time of your death.

A surviving spouse may be eligible for benefits as early as age 60, though it will be reduced. They are eligible for full benefits if they have reached their full retirement age. Surviving spouses can also switch to their own Social Security retirement benefits when they reach retirement age, in which case the survivor benefit would cease.

If your surviving spouse is caring for children under the age of 18, they do not have to wait for the survivor benefits.

Your children are also eligible for survivor benefits if they are under the age of 18 (or under age 19 but are still enrolled in high school). A disabled child can receive benefits until age 22. Note that these benefits will reduce or even cancel out FERS survivor annuities for children.

How to Get Help

Thinking about death is difficult, but it’s crucial to plan for your family’s wellbeing. If you’re a federal employee with questions about your benefits, please reach out. We’re financial planning experts with deep knowledge of the FERS system, and can help you with anything from designating your beneficiaries to helping you choose the right insurance coverage’s for your financial situation.

If you are a surviving spouse of a federal employee, we’re here for you, too. This Survivor’s Planning Checklist will help you stay organized as you complete all the necessary paperwork. If you need additional help navigating the complex federal benefits system, get in touch today. We can help you make sure you understand what you’re entitled to and help you through this difficult time.

One of the biggest expenses in your life is federal income tax. Sure, writing the check for the payment on your home is a major milestone, but most people will end up paying far more than that in taxes over the course of a lifetime.

And yet, you’re probably not paying as much as you think.

You read that correctly! One of the biggest misconceptions people have about their taxes surrounds their tax rates and how they work. And this misunderstanding leads most people to think they owe more than they actually do.

The trouble comes from a complex tax code that uses tax margins to tax different levels of income at different rates. Understanding exactly how this works is crucial for making good decisions about your money.

So let’s clear up the misconceptions and misunderstandings. Here’s what you need to know.

What Is Your Marginal Rate?

Tax margins are the result of a progressive tax system, in which people with lower income pay taxes at a lower rate, while people with higher incomes are charged more. Higher tax rates kick in when you cross a certain income threshold, creating what we call tax brackets:

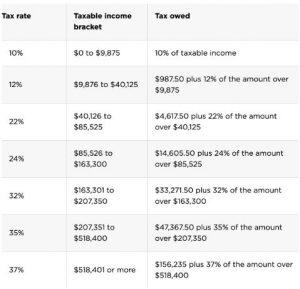

Single Filer 2020 Federal Income Tax Brackets

Source: NerdWallet

Let’s look at an example. If a single person earned $45,000 of taxable income in 2020, they’d be in the 22% tax bracket.

But that does not mean they pay 22% in income taxes.

In reality, they only pay 22% tax on part of their income — specifically, the part that kicks them over the $40,125 limit of the 12% bracket.

The best way to understand this is to imagine each tax bracket like a bucket. Everyone’s income is first poured into the 10% tax bucket. But that bucket only holds $9,875. If your taxable income is less than that, then you’re done — you only owe 10% in taxes.

But if your taxable income is more than $9,875, it will spill over into the next bucket. This is the 12% bucket. This bucket holds up to $40,125, so our sample tax payer above has income that will also spill into the third bucket. But the 22% bucket is where he stops, because it holds more than $48,000.

Our taxpayer will pay the taxes on each bucket, meaning he will pay 10% on the $9,875 in the first bucket, 12% on the $30,250 in that bucket, and 22% on the rest — but that 22% bucket only has $4,875 in it.

So while this taxpayer has a marginal tax rate of 22% — the highest bracket he falls into — he won’t pay 22% on all of his money. His effective tax rate is actually lower.

What Is Your Effective Tax Rate?

Your effective tax rate is the percentage of your income that you actually pay in taxes — and this is almost always less than your marginal rate. This is much easier to calculate: just take the total dollar amount you pay in income tax and divide it by your total income.

To see how it works, let’s calculate the effective tax rate for our sample taxpayer. He paid:

- 10% on $9,875 = $987.50

- 12% on $30,250 = $3,630.00

- 22% on $4,875 = $1,072.50

That’s a total of $5,690 in income tax. That means his effective tax rate is:

- $5,690 ÷ $45,000 = 0.126, or 12.6%

As you can see, our sample taxpayer doesn’t pay anywhere near 22% on his income — his effective tax rate is only 12.6%.

This is great news, and it should hopefully lay to rest the myth that being pushed into a higher tax bracket suddenly takes all your money away, or that you could actually end up owing all the extra money you earn, making it somehow not worth getting a raise. This is simply not true.

Using Your Marginal and Effective Tax Rates to Make Good Decisions

Your effective tax rate is a snapshot of your total tax burden, which can be useful in monthly and yearly budgeting. For example, freelancers and other workers with 1099 income with no tax withholding can use their effective tax rate to plan ahead and avoid a shock when their tax bills are due in April. The same is true for retirees who want to have a clear understanding of what they’ll owe on their IRA distributions.

Your marginal tax rate, on the other hand, is important for making strategic retirement decisions. That’s because any additional tax deferred retirement account (IRA, 401k, 403b, TSP, 457) income you withdraw will be taxed at your marginal rate — that is, your current “bucket” that you’ve worked your way up to. If you have flexibility about taking a distribution now or later, using your marginal rate to compare options will give you a more accurate view of what those changes will cost and can help you save money in the long run.

It should be noted that these calculations can get complicated. For example, you might want to figure your state taxes into your effective tax rate, or you may need help calculating an accurate marginal tax rate if some of your strategies push you into a higher bracket. We’re here to help! Tax planning is a crucial part of retirement planning, so please get in touch if you have additional questions about how your marginal and effective tax rates impact your retirement plan.

Who among us couldn’t use a little extra cash? If you’re a federal employee or retiree, you could be eligible for an extra $800 in your pocket this year, and there really are no strings attached. All you need to do is apply, and if you’re eligible, you get paid.

Here’s what you need to know.

The BCBS Medical Reimbursement for Medicare Part B Premiums

As a federal employee, you enjoy some amazing benefits — and one of the biggest is your healthcare plan. Fortunately, these benefits continue into your retirement and can make enjoying good health insurance affordable. Blue Cross Blue Shield offers the most popular plan for retired federal employees, and it’s easy to see why.

If you have the BCBS Basic plan through the Federal Employee Health Benefits Program, BCBS will reimburse you up to $800 for your Medicare Part B premiums. An eligible spouse can also receive this reimbursement, so a couple could enjoy a mini-windfall of $1,600.

The best part is that ths reimbursement is yours to do with as you please. There are no limitations or regulations about how you spend the money, so you could put it toward future healthcare spending, repairs on your home, or a vacation you’ve been longing to take. It’s all up to you!

Who Is Eligible for the Reimbursement?

To be eligible for the $800, you need to meet the following requirements:

- You are a current or retired federal employee.

- You have the BCBS Basic Option for health insurance. Standard Option and FEP Blue Focus members are not eligible.

- You pay for Medicare Part B. This is additional coverage beyond the Medicare Part A that Americans over age 65 automatically receive.

Note that your spouse is also eligible for their own reimbursement of up to $800 if they also meet these requirements.

How Do I Apply?

BCBS offers a streamlined application process that makes it easy to take advantage of this benefit. There are four ways to apply:

- Online at fepblue.org/mra

- Via the EZ Receipts app, available at the App Store or Google Play

- By fax at 877-353-9236

- By mail at P.O. Box 14053, Lexington, KY 40512

Applying online or with the app will get you the fastest results, often within one or two business days. These options also allow you to choose direct deposit, further speeding the process.

Applications processed by fax or mail can take up to 10 business days, and your reimbursement will be mailed as a paper check.

To apply, you’ll need to provide proof of payment of your Medicare Part B premium. There are several acceptable ways to do this:

- A Social Security Cost of Living Adjustment (COLA) statement

- A canceled check

- A copy of your credit card statement

- A copy of your bank statement

You will also need to submit your Medicare Part B premium bill that matches the amount you paid.

The deadline to apply is December 31 of the following benefit year. That may seem like a long time, but why wait?

What’s Next?

Once you receive your reimbursement, all that’s left to do is figure out how to spend it — or how to save it.

You can also check out our blog for more great information and advice to help federal employees make the most of their retirement savings.

While heading to the office each day may feel pretty much the same no matter where you work, there are some big differences in the working lives of federal employees. One of the major things that set careers in public service apart is the retirement system. The Federal Employee Retirement System (FERS) is a major benefit for civilian workers in the federal government, but its rules are complex. If you don’t fully understand them, you could make a costly mistake that keeps you from maximizing your pension during retirement.

One of the most crucial rules to know is the one about early retirement. There are actually two types of retirement that are commonly confused with one another: postponed retirement and deferred retirement. Each method of early retirement has different rules, so you’ll want to be clear on the pros and cons of each to make a smart choice about when you finally turn in your ID badge and begin retired life in earnest.

FERS Basics

FERS Annuity is a defined benefit plan that guarantees a certain payout for each year of your retirement in exchange for required contributions during your working years. Unlike the Thrift Savings Plan, you’ll never have to wonder how much you can afford to withdraw from your TSP, because your FERS annuity is not subject to the whims of the stock market.

That’s the good news. The less good news is that a FERS annuity comes with a serious set of rules about when you can retire and what benefits you’ll be eligible for during your retirement.

Retiring after 30 or 40 years of uninterrupted service is pretty straightforward, but what if you want to retire early — before certain criteria are met? You have two choices.

FERS Postponed Retirement

To be eligible for a postponed retirement, you need to meet three big requirements:

- 10 years of creditable service in a position covered by FERS

- Reach your minimum retirement age (MRA) before you leave your position

- Keep all of your contributions in the FERS system

If you can do all three of these things, you can retire before age 62 — in fact, you can start to collect your pension immediately. However, doing so could shut you out of a big portion of your pension, since your benefits will be reduced by a certain percentage for each year under age 62 you are at retirement.

Choosing a postponed retirement lets you maximize your pension payments by holding off on collecting them. You’re essentially waiting to collect until you reach the age at which you would have been eligible for your full benefit — typically age 60 or 62, depending on your years of service.

The other major benefit of a postponed retirement is that you will remain eligible for Federal Employee Health Benefits (FEHB) and Federal Employees’ Group Life Insurance (FEGLI) when you do retire. You will not receive pension income or FEHB when you stop working until you apply for your benefits, but postponing them can help you maximize your pension income and provide excellent health coverage as you age.

The Bottom Line: If you are eligible for a MRA+10 retirement, you can postpone collecting benefits to increase your pension payout and reinstate FEHB when you do finally activate retirement benefits.

FERS Deferred Retirement

Though the words “postpone” and “defer” seem synonymous, they have very different meanings when it comes to FERS. To be eligible for a deferred retirement, you only need to meet two requirements:

- 5 years of creditable service in a position covered by FERS

- Keep all of your contributions in the FERS system

The big difference here is that you can take a deferred retirement at any age — you do not need to meet your MRA before you separate from service.

But there’s also a big drawback: You will not be eligible to reinstate FEHB when you apply for your pension. This means that you will need to secure your own health insurance until you are eligible for Medicare at age 65. You will also not be eligible for the special retirement supplement (SRS) benefit or to re-enroll in FEGLI when you do finally apply for your pension.

The Bottom Line: Deferred retirement allows you to collect your pension with fewer years of service and to retire earlier, but losing your FEHB eligibility can be a big blow.

Should You Postpone, Defer or Keep Working?

The right decision for you depends on many factors: your current age, your years of creditable service, whether you have an affordable health insurance alternative, and more. As you consider which form of early retirement to choose, it’s helpful to calculate your pension under several different scenarios to compare and contrast your options and make a fully informed decision.

Need help with the math? We can help you game out your FERS options and come up with detailed plans to cover you while you wait for your pension to kick in. Solid financial planning will help you make the most of your FERS benefits, so contact us today to get started.

Medicare is a fantastic benefit that makes it possible for many retirees to enjoy life more fully, thanks to premiums that are far more affordable than market rates on private health insurance plans. Still, Medicare isn’t free, and there are some sneaky extra costs that can blindside you if your income rises above a certain threshold.

Friends, meet IRMAA.

Just as a sudden windfall or boost in your retirement income can bump you into a higher tax bracket, so too can it push you into a higher payment tier for your Medicare Part B and Part D coverage.

Fortunately, unplanned IRMAA expenses can be avoided with careful planning. Here’s what you need to know.

Understanding IRMAA

IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some people’s Medicare premiums. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage.

IRMAA charges affect premiums for Medicare Part B (medical insurance) and Part D (prescription drug coverage) plans. If you have a Medicare Advantage plan, you will also be subject to IRMAA charges on the affected portions of the plan.

IRMAA charges are based on your yearly income as reported on your tax return. Specifically, the Social Security Administration (SSA) uses your Modified Adjusted Gross Income (MAGI) for its calculations.

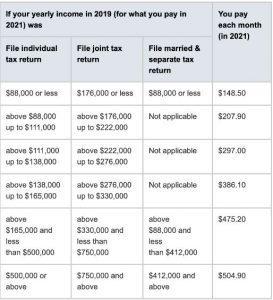

For this year, anyone earning less than $88,000 filing single or $176,000 filing joint will not have an IRMAA charge: your monthly premium is the standard $148.50 per person, per month.

However, if you earn more than that, you will be charged extra based on your income bracket:

Source: medicare.gov

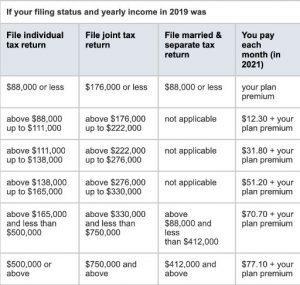

Likewise, you will also be charged extra for Part D coverage, following the same income brackets:

Source: medicare.gov

Why IRMAA Can Be Tricky

When the SSA determines your IRMAA charges, they use your MAGI from two years prior to the year in question. For example, premiums for 2021 are based on the income from your 2019 tax return.

This means that decisions you make could come back to haunt you in the future.

For example, if you sell some real estate and earn a profit, that money could push your income into a higher tax bracket and a higher IRMAA bracket. While you’ll pay income taxes on the proceeds relatively quickly, the IRMAA charges will be delayed, which leaves you open to a budget shortfall if you’re caught off-guard.

The income thresholds for IRMAA brackets are also subject to change each year, making it harder to plan ahead. That’s because IRMAA thresholds are no longer frozen but instead tied to inflation using the Consumer Price Index. You can make an educated guess about next year’s premiums and IRMAA thresholds before official numbers are published, but you’ll want to pad this number to avoid an unpleasant surprise.

Finally, major life events can have a big impact on your income, and this can in turn affect your IRMAA charges in the future. Fortunately, the SSA will consider an appeal if your circumstances have changed and your income is significantly lower than it was in the tax year used for your determination. Not everything that impacts your income is officially recognized, but these events could help your appeal:

- Death of a spouse

- Divorce or annulment

- Loss or reduction of a pension

- Loss of property that generates income

- Marriage

- Settlement payments from an employer

- Unemployment or reduced hours/income

Tips for Avoiding an IRMAA Charge

In general, the best way to avoid unwanted IRMAA charges is to make sure your income remains steady throughout retirement. This means remaining just as vigilant about your IRMAA bracket as you are about your marginal tax rates. This is especially important if your income hovers near the top of your current bracket, as you will have less room for error.

Some common income-boosters to be aware of include:

- Selling real estate, especially if you’ve owned it for a long time and it has significantly increased in value.

- Selling investments subject to capital gains taxes. These transactions typically occur outside of your IRA or 401(k) in brokerage accounts.

- Converting a traditional IRA to a Roth, which leaves you open to a big tax liability and IRMAA charges on the lump sum, which is considered income.

Another common income-booster comes when you turn 72 and must take required minimum distributions (RMD) from a traditional IRA, 401(k), TSP. If you plan carefully, you can reduce other portions of your income so this balances out, or you can consider giving your RMD to charity if you itemize deductions.

Feeling a little dizzy from all the things you have to keep track of in retirement? Get in touch today to learn more.

If you’re a federal employee or member of the armed forces, your retirement options are slightly different than those of your friends and neighbors in the private sector. But just like anyone else, it pays to plan ahead and know the rules when it comes to your retirement.

If you’ve invested in a Thrift Savings Plan (TSP) for your retirement, you’ve hopefully been investing as much as you can throughout your career — ideally maxing it out, but at least contributing 5% of your salary to take full advantage of the government’s matching funds.

But it’s not quite time to pat yourself on the back yet. If you’re nearing retirement age, you still have significant planning to do. One potential pitfall for TSP investors?

An unpaid TSP loan.

What Is a TSP Loan?

When you have a TSP account, you are allowed to take out a loan against your own investment. This is similar to borrowing against a 401(k) plan in the private sector. There are two types of TSP loans: General Purpose and Residential. A General Purpose loan can be used for any reason and must be paid back within 5 years. A Residential loan must be used to buy or build a primary residence (i.e., your main home rather than a vacation home) and must be paid back within 15 years.

TSP loans are attractive because they currently have a much lower interest rate than a commercial mortgage, student loan, or other financing — and a very much lower interest rate than a credit card. They’re also convenient because you’ll repay the loan with payroll deductions that come directly out of your paycheck, so you never have to worry about missing a payment.

Heading Into Retirement With a TSP Loan

If you are nearing retirement age and are still paying off a TSP loan, you need to do some additional planning. If possible, it’s best to pay your loan off before retirement age. If you’d like to retire before your loan is knocked out, you can make additional payments by sending a check in the mail along with a loan payment coupon. You can pay a little extra each month, use your tax refunds to give yourself a boost, or pay the balance in one lump sum if you can afford it. We’re happy to help you calculate the best plan for your situation!

If you aren’t able to pay your loan down early, don’t worry: you can still retire with an outstanding TSP loan. No one will force you to continue working until it’s paid off.

However, there are some drawbacks to be aware of if your loan is unpaid at the date of your retirement.

The TSP is required by law to report any unpaid loan balance — for both General Purpose and Residential loans — as a taxable distribution. You have a 90-day grace period to pay it off before this happens.

If you can’t pay the remaining balance by then, you will owe income taxes — both federal and state — at your regular rate on the outstanding balance and interest. Depending on the size of your balance, this could be a sizable tax trap that eats up your refund and could even leave you owing a big chunk of change come April.

Also, you may be subject to the IRS 10% early withdrawal penalty, unless you turn 55 or older in the calendar year in which you separate from federal service.

Some Silver Linings and Additional Details

If your TSP loan was made against a Roth account, you may not have to pay income taxes on some or all of the unpaid loan amount — though you may still owe a penalty if you are under the age of 55. That’s because a Roth retirement account is for income that was already taxed before you contributed to the retirement account. You cannot be double taxed on this income.

If some of your TSP contributions are traditional and some are Roth, the tax calculations become complex quickly. A good financial advisor will help you make the calculations and sort out the details so you can avoid costly errors on your tax filing the year you retire.

You can also move funds from your TSP to a different IRA if you wish. To do this, you’ll still need to pay the loan off — but you may be able to buy a little extra time to do so. That’s because you have an additional 60 days from the time the taxable distribution is declared (i.e., at the end of the 90-day grace period) to complete the rollover and pay the loan amount into your IRA with other funds.

It’s important to note that these funds must have already been taxed, so you can’t just create a revolving door of rollover funds from various IRAs to get the job done.

Get the Help and Advice You Need

Confused? That’s understandable! The tax implications of an unpaid TSP loan can get complicated fast.

That’s why it’s so important to talk to a tax-savvy financial advisor well in advance of retirement. We’ll help you plan your TSP loan repayment to help you avoid the worst, and we’ll make sure that all your paperwork and tax forms are done correctly to help you avoid paying any more than you rightfully should.

Need help with your retirement plan and federal employee benefits? Get in touch today to see how you can get the most out of your investments and enjoy the retirement you deserve.