The Difference Between Marginal Tax Rates and Effective Tax Rates

One of the biggest expenses in your life is federal income tax. Sure, writing the check for the payment on your home is a major milestone, but most people will end up paying far more than that in taxes over the course of a lifetime.

And yet, you’re probably not paying as much as you think.

You read that correctly! One of the biggest misconceptions people have about their taxes surrounds their tax rates and how they work. And this misunderstanding leads most people to think they owe more than they actually do.

The trouble comes from a complex tax code that uses tax margins to tax different levels of income at different rates. Understanding exactly how this works is crucial for making good decisions about your money.

So let’s clear up the misconceptions and misunderstandings. Here’s what you need to know.

What Is Your Marginal Rate?

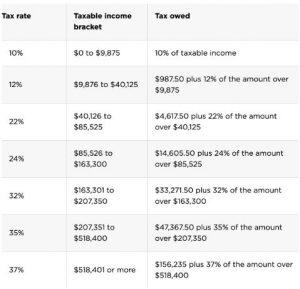

Tax margins are the result of a progressive tax system, in which people with lower income pay taxes at a lower rate, while people with higher incomes are charged more. Higher tax rates kick in when you cross a certain income threshold, creating what we call tax brackets:

Single Filer 2020 Federal Income Tax Brackets

Source: NerdWallet

Let’s look at an example. If a single person earned $45,000 of taxable income in 2020, they’d be in the 22% tax bracket.

But that does not mean they pay 22% in income taxes.

In reality, they only pay 22% tax on part of their income — specifically, the part that kicks them over the $40,125 limit of the 12% bracket.

The best way to understand this is to imagine each tax bracket like a bucket. Everyone’s income is first poured into the 10% tax bucket. But that bucket only holds $9,875. If your taxable income is less than that, then you’re done — you only owe 10% in taxes.

But if your taxable income is more than $9,875, it will spill over into the next bucket. This is the 12% bucket. This bucket holds up to $40,125, so our sample tax payer above has income that will also spill into the third bucket. But the 22% bucket is where he stops, because it holds more than $48,000.

Our taxpayer will pay the taxes on each bucket, meaning he will pay 10% on the $9,875 in the first bucket, 12% on the $30,250 in that bucket, and 22% on the rest — but that 22% bucket only has $4,875 in it.

So while this taxpayer has a marginal tax rate of 22% — the highest bracket he falls into — he won’t pay 22% on all of his money. His effective tax rate is actually lower.

What Is Your Effective Tax Rate?

Your effective tax rate is the percentage of your income that you actually pay in taxes — and this is almost always less than your marginal rate. This is much easier to calculate: just take the total dollar amount you pay in income tax and divide it by your total income.

To see how it works, let’s calculate the effective tax rate for our sample taxpayer. He paid:

- 10% on $9,875 = $987.50

- 12% on $30,250 = $3,630.00

- 22% on $4,875 = $1,072.50

That’s a total of $5,690 in income tax. That means his effective tax rate is:

- $5,690 ÷ $45,000 = 0.126, or 12.6%

As you can see, our sample taxpayer doesn’t pay anywhere near 22% on his income — his effective tax rate is only 12.6%.

This is great news, and it should hopefully lay to rest the myth that being pushed into a higher tax bracket suddenly takes all your money away, or that you could actually end up owing all the extra money you earn, making it somehow not worth getting a raise. This is simply not true.

Using Your Marginal and Effective Tax Rates to Make Good Decisions

Your effective tax rate is a snapshot of your total tax burden, which can be useful in monthly and yearly budgeting. For example, freelancers and other workers with 1099 income with no tax withholding can use their effective tax rate to plan ahead and avoid a shock when their tax bills are due in April. The same is true for retirees who want to have a clear understanding of what they’ll owe on their IRA distributions.

Your marginal tax rate, on the other hand, is important for making strategic retirement decisions. That’s because any additional tax deferred retirement account (IRA, 401k, 403b, TSP, 457) income you withdraw will be taxed at your marginal rate — that is, your current “bucket” that you’ve worked your way up to. If you have flexibility about taking a distribution now or later, using your marginal rate to compare options will give you a more accurate view of what those changes will cost and can help you save money in the long run.

It should be noted that these calculations can get complicated. For example, you might want to figure your state taxes into your effective tax rate, or you may need help calculating an accurate marginal tax rate if some of your strategies push you into a higher bracket. We’re here to help! Tax planning is a crucial part of retirement planning, so please get in touch if you have additional questions about how your marginal and effective tax rates impact your retirement plan.